It’s hard to believe, but another year has already flown by. Once again, the time has come where we like to look back on the year past, and look forward on the year to come. As we move in to the new year, many people like to make resolutions regarding friendships, diet, exercise, and other habits. These are important, but let’s not forget about our finances. The new year can be a great time to reflect on our financial successes and flops, and figure out how to do better in the year to come. It’s important to set goals that are both a little challenging, but also attainable. With consistency, little steps will take you a long way!

Make a Budget

It seems that whenever someone drops the word ‘budget,’ people run and hide. It sounds so scary. So complicated. But it doesn’t have to be.

It can be a simple back of the envelope plan for your money. Figure out how much money you bring home in a month. Then add up your regular expenses. Will you have enough money to cover those expenses? If so, great! If not, figure out where you can start eliminating expenses (or increasing income).

Once you have your regular expenses accounted for, you know how much extra spending money you have. As the year goes on, keep track of how well you stick to your budget. Don’t get bent out of shape if you don’t always stick to the budget. Instead learn from where you got off, and try to do better the following month. Stick to it, and by the end of the year, you’ll have a much better idea of where your money is going, and hopefully you’ll be consistently spending less than you earn.

Pay Off Some Debt

If you feel like you’re drowning in debt, you aren’t alone. Often, all your debt can seem insurmountable. And together it is. But rather than looking at the whole thing, pick one piece of the debt to tackle. Maybe you decide to pay off a high interest store credit card. Or maybe you aim to reduce your balance on a larger loan by a certain amount. Whatever it is, tackle it with a vengeance. Show it who’s boss. Use any extra money you can find to make extra payments until you’ve reached your goal. Chances are, once you do reach your goal, you’ll be motivated to keep going!

Improve your Credit Score

Most people have a credit score that has room for improvement. Regardless of where your credit score is, there are some easy things to improve it over the next year.

The most important thing for your credit score is to make all your payments on time. If you’ve been missing payments, figure out why. If it’s because you’re coming up short at the end of the month, go back to making a budget and see if you can figure out why you’re coming up short. If there’s simply no way you can squeeze all your payments out of your income, perhaps you need to negotiate a payment plan with some of your lenders.

If you are simply forgetting to make payments, sign up for the auto-pay service that most lenders provide. As long as you ensure there is money in your bank account to cover the payment, this is the best way to ensure you don’t miss a payment.

Almost as important as making all your payments on time is keeping a moderate to low credit utilization ratio- or the amount of your debt compared to the debt available to you. One way your credit utilization ratio might spiral out of control is by maxing out their cards. If this happens fairly often, consider cutting back on your credit card use- perhaps only using it for a handful of routing expenses, and then ensuring that each month you pay off that month’s purchases.

Sticking to Your 2018 Money Resolutions

Give each of these three resolutions just a year, and you’ll be shocked by how much of a difference they make. However, most New Year’s resolutions fail in the first few months. Rather than letting your resolution become part of that statistic, take a few steps to make yours stick.

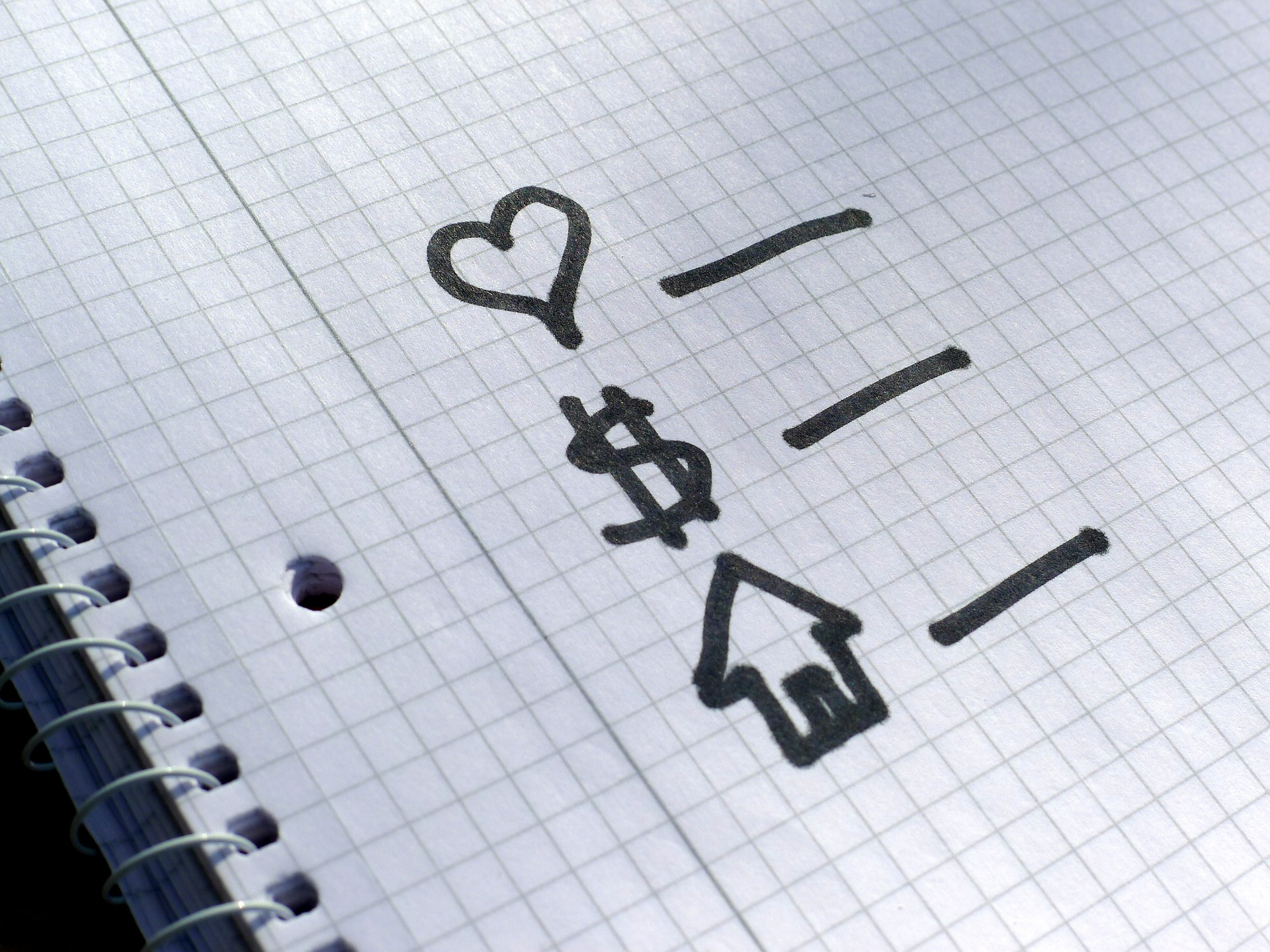

Most important, write your resolution down. Stick it where you’ll see it. Make it prominent. Add some graphics to make it pop. As the year goes by, track your progress in writing. For example, if you’re paying down debt, perhaps use a visual way to display your progress.

If you have a good friend who you’re comfortable sharing personal details with, let them know your new years resolution and ask them to keep you accountable. Better yet, the two of you might be able to adopt the same resolution and keep each other accountable. If your goal involves cutting back on spending, it will be especially helpful to have a friend who’s sharing your goal so you don’t feel pressured to always go on spendy outings.

Finally, don’t give up. Try your best to keep your resolution as well as you can, but if you don’t, just pick yourself up again and try again. Mistakes are natural. Just keep working on getting better at your resolution.